The UK’s leading rural insurer NFU Mutual is urging people to be on their guard against Storm Debi as it reveals it has received over 1,800 claims from recent storms.

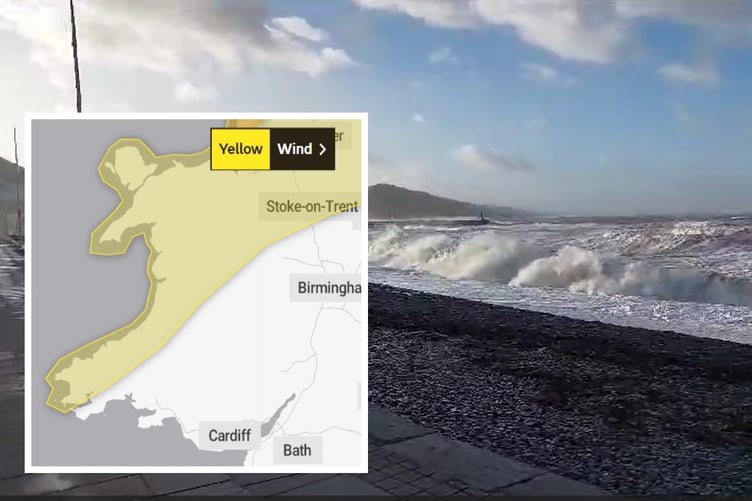

Storm Debi will hit Wales, the north west of England, Scotland and Northern Ireland on Monday night and follows soon after Storms Babet and Ciaran wreaked havoc across the country.

Andrew Chalk, rural insurance specialist at NFU Mutual, said: “As the UK’s leading rural insurer, we know isolated rural communities, farms and dwellings are more at risk from extreme weather and hitting shortly after Storms Babet and Ciaran, we’re urging people not to underestimate the potential for destruction during Storm Debi.

“We’ve received over 1,800 claims relating to storm damage in recent weeks, which goes to show just how widespread the impact of these storms can be.

“NFU Mutual has again activated its storm plan, with loss adjusters and repair networks stood up for an influx of claims and our Agents in communities across the UK ready to assist customers, but we implore everyone not to take unnecessary risks.

“Safety for farmers, family members and workers should always be the number one priority and while fully understanding the pressures farmers and rural businesses are under, it is vital they avoid taking risks which could lead to injury or fatalities.

“Farmers can consider moving livestock to higher ground to protect them from flood water as well as moving machinery and electrical items.

“It is also worth checking alternative fuel and power sources in case of a power cut or disruption, such as making sure generators are in working condition and able to run at full load for long periods of time.

“For those living in rural areas, consider removing loose furniture from gardens where possible and keep doors and windows securely shut. Also move cars away from branches, tiles or walls if you can.”

NFU Mutual has provided a handy guide for property owners on how they can secure their property before a storm or flood.

In addition to preparing for the storm, property owners who suffer damage should think about how they can make their property more resilient to heavy rain and high winds in the future.

Regularly pruning trees, keeping outbuildings, sheds and greenhouses secure, maintaining tiles on your roof and having somewhere to put – or means to secure – garden furniture can all reduce the risk of damage from high winds.

Similarly, there are repairs that can be made after flooding which make your property more flood resilient in the future.

Measures such as raising electrical flooring, tiling instead of carpeting and using waterproof paint all cost the same or little more than like for like repairs, but can save a lot of money in the event of a future flood.

Larger resilience measures such as fitting non-return valves, flood doors or tanking or pump systems will cost more, but since 2017 NFU Mutual has helped customers with these larger flood resilient repairs.

As part of the scheme, customers who suffer flood damage to their buildings above £10,000 receive a contribution from NFU Mutual to implement repairs which will protect the property from future flooding.

NFU Mutual’s storm resilience guide:

• Make sure all doors and windows can be securely closed.

• Prepare for power cuts: Have torches and batteries to hand and make sure any generators are ready to use if required. If you are using candles, make sure you use them safely and extinguish when leaving the room, and make sure nothing hangs over the candles.

• Inspect your property and make repairs to things like loose fence panels or gates.

• Make sure gutters are not leaking and are clear of leaves and other debris.

• Have a space to put loose outdoor furniture like garden chairs and trampolines. If you do not have an indoor space in which to put them, ensure you have a means of tying down or otherwise securing the furniture.

• Safely check that tiles, slates and roofing sheets are in place, securing any that are not.

• Inspect trees on your property, removing loose or overhanging branches which may cause damage to your or others’ property in a storm.

• Repair or unblock any faulty drains.

• If you have a garage, clear a space for your vehicle in the event of a storm. If you do not have a garage, plan where you can park vehicle during a storm – this should be away from any walls, fences or branches which could fall and damage the vehicle.

• Protect and lag water pipes in vulnerable areas and know where the water supply is so that you can turn it off in the event of burst pipes.

• Stay alert for Met Office weather warnings in your area.

• Have your insurer’s emergency helpline number available.

In addition to the above, business owners can:

• Ensure you have emergency contact details for employees to maintain contact during an extreme weather event.

• If you have company vehicles, make sure these are parked away from walls, fences or branches which could damage the vehicles.

• Make sure outdoor signage or displays can be secured or brought inside.

• Ensure you have adequate signage warning customers of things like wet floors that may be more common during extreme weather.

• Prepare an emergency evacuation route in the event of unexpectedly severe weather.

• Ensure central heating will come on during freezing weather to avoid frozen pipes, and consider procuring sandbags to protect your business in the event of a flood.

• Make sure you have a way of communicating closures with customers.

• Consider transport routes to the business and whether traveling will be safe and practical.

While driving:

• Drive slowly and steadily and leave larger gaps between vehicles. Wet conditions can increase stopping distances by ten times.

• In windy weather, leave plenty of room when passing other road users, particularly vulnerable road users like walkers, cyclists and motorcyclists.

• Avoid braking suddenly, slowing down gently before corners and junctions.

• Accelerate slowly, keeping revs low.

• Take care coming up to junctions where road markings may be less visible.

Comments

This article has no comments yet. Be the first to leave a comment.